I have to admit it: I’m a news junky. I’m addicted to my Twitter timeline, RSS feed, and often frequent the comment sections of Hacker News, Quora, Reddit, AVC, etc. I love it all. There is so much great stuff out there.

My news habit comes with great rewards. Building startups is such a difficult task, it helps to be a sponge and soak in the knowledge people are sharing across product, design, development, growth, marketing, community, data science, analytics, industry trends, etc. Everyday, I come across awesome stuff that alters my perspective, teaches me valuable lessons, or even solves my current problem of the day!

The only problem is that all of this requires a significant amount of time and effort. Let’s take Twitter as an example. It takes time to learn how Twitter works. It takes time to find the right people to follow, as well as discover who to unfollow. And, it takes time to sift through 1000+ tweets for the golden nuggets that invariably appear. RSS, HN, Quora, and Reddit are different, but time consuming in other ways.

So how do I keep the rewards, but save myself the time and effort?

A simple experiment.

This summer, while rifling through ideas and hacks with my friend Leslie in the Pejman Mar Summer Founders Program, we stumbled across something. Among the hacks was a little tool to discover frequently-shared links by 300+ venture capitalists on Twitter. It started super simple, but proved useful as an instant way to capture the daily conversation in the venture capital community.

We hopped into Gmail and sent the top 10 links of the day to two people at Pejman Mar. The next day, after positive reviews from our sample set of two, we created a Mailchimp account and began adding more friends, colleagues, and advisors to the mailing list. After playing around with so many ideas, it was cool to be able to send out this daily email that people we knew enjoyed.

In the following days and weeks, people began trickling into the mailing list from word of mouth. Our friends continually let us know that they loved the email, and wanted us to keep them coming. New users would email in to tell us how it covered much of their startup news needs. Mailchimp analytics showed us awesome email open and click through rates.

Great! So, why not make this the start of a thing?

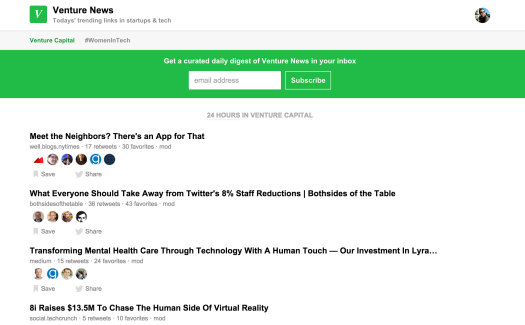

Venture News

We registered a domain at http://www.venturenews.co, and put up our mailing list signup, as well as a live version of the links. Soon after that, Chris Messina posted Venture News to Product Hunt, which was relatively well received.

What now? Leslie and I are experimenting on the newsletter and on the website. We’re balancing new product features, talking with subscribers, and developing a broader vision for the future. It’s exciting, and feels like the seed of a news experience that includes just the gold nuggets without requiring much time or effort.

If you’re interested in a quick fix of startup news with minimum hassle, please give Venture News a spin. Even better, sign up for the mailing list to get a curated daily digest delivered directly to your inbox. Hopefully we can help simplify your daily tech startup news habit 🙂